“The tax on capital gains directly affects investment decisions, the mobility and flow of risk capital… the ease or difficulty experienced by new ventures in obtaining capital, and thereby the strength and potential for growth in the economy.”

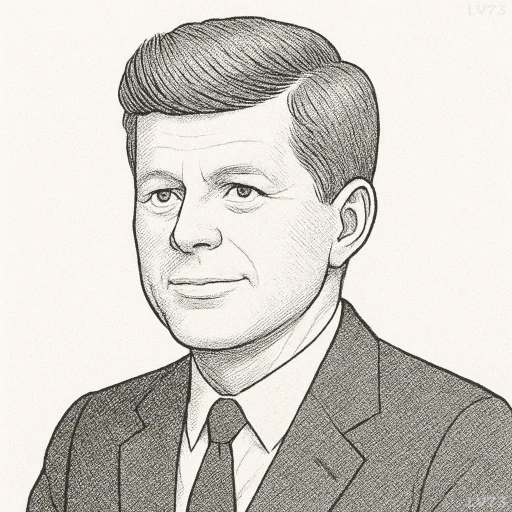

- May 29, 1917 – November 22, 1963

- American

- Politician

table of contents

Quote

“The tax on capital gains directly affects investment decisions, the mobility and flow of risk capital… the ease or difficulty experienced by new ventures in obtaining capital, and thereby the strength and potential for growth in the economy.”

Explanation

In this statement, John F. Kennedy highlights the critical relationship between capital gains taxes and the overall health of the economy. Capital gains taxes are levied on the profits made from the sale of assets such as stocks, real estate, and business investments. Kennedy argues that these taxes have a direct impact on investment decisions by influencing how much risk investors are willing to take. High taxes on capital gains can discourage investment and slow the flow of capital, as investors may be less inclined to allocate funds toward potentially lucrative ventures if they are taxed heavily on the returns.

Kennedy goes on to explain that the mobility of risk capital—money used to fund new or untested ventures—depends on the ease with which investors can obtain returns on their investments. If capital gains taxes are high, investors may hesitate to invest in startups or new projects, which in turn makes it harder for entrepreneurs to secure the capital they need to launch or grow their businesses. This, according to Kennedy, has a dampening effect on the entrepreneurial spirit and the overall potential for economic growth. The difficulty new ventures face in accessing capital directly influences the strength of the economy, as it reduces innovation, job creation, and the dynamism that come from a robust startup ecosystem.

Kennedy’s statement touches on the broader principle that tax policy plays a pivotal role in shaping the economic landscape. By setting taxes on capital gains at appropriate levels, the government can encourage investment, promote business growth, and foster a healthy, competitive economy. Today, this concept remains relevant as policymakers debate the balance between tax fairness and economic incentive. If capital gains taxes are set too high, it could stifle investment and growth, while taxes that are too low could lead to inequities or reduced government revenues for essential public services. The key, as Kennedy suggests, is to craft policies that stimulate investment without overly burdening the economy or creating barriers to entrepreneurial innovation.

Would you like to share your impressions or related stories about this quote in the comments section?