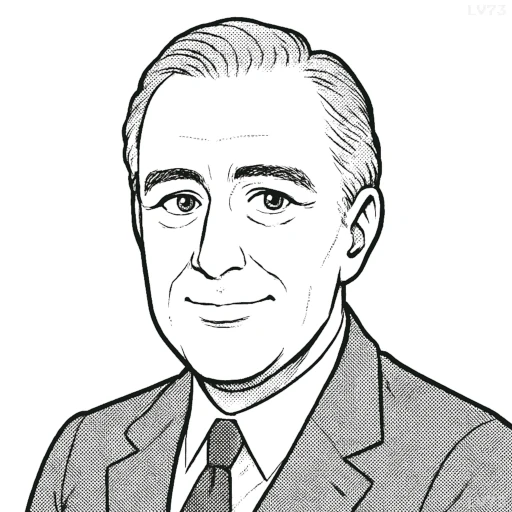

“Here is my principle: Taxes shall be levied according to ability to pay. That is the only American principle.”

- January 30, 1882 – April 12, 1945

- American

- The 32nd President of the United States, Politician

table of contents

Quote

“Here is my principle: Taxes shall be levied according to ability to pay. That is the only American principle.”

Explanation

In this quote, Franklin D. Roosevelt emphasizes the fundamental belief that the tax system should be structured in a way that is fair and just, ensuring that individuals contribute based on their financial capacity. Roosevelt’s principle of “ability to pay” was a core element of his economic vision, reflecting his belief in progressive taxation. During his presidency, Roosevelt sought to reduce economic inequality, and he believed that wealthier individuals and corporations should contribute a larger share to the nation’s welfare. This principle was evident in the New Deal policies, where Roosevelt pushed for higher taxes on the wealthy to help fund social programs that would assist the poor and middle class, especially during the Great Depression.

The quote also highlights Roosevelt’s understanding of social responsibility and his commitment to addressing the economic disparities that existed in the country. He saw the tax system as a tool for promoting economic justice and creating a fairer society. The notion that taxes should be based on ability to pay aligns with Roosevelt’s broader goal of reducing income inequality and ensuring that government policies supported the common good, rather than simply benefiting the wealthy few.

In today’s context, Roosevelt’s principle continues to shape debates about tax policy, especially in the face of growing wealth inequality. The idea of a progressive tax system remains a central issue in modern politics, with ongoing discussions about the need for tax reform that ensures the wealthiest Americans pay a fair share. For example, the debate over tax cuts for the rich versus increased taxes on high-income earners reflects the ongoing tension between those who advocate for lower taxes on the wealthy and those who push for a fairer tax system that addresses social and economic inequalities. Roosevelt’s words remain a powerful reminder of the idea that the most prosperous should contribute proportionally to the well-being of the nation.

Would you like to share your impressions or related stories about this quote in the comments section?